J.P. Morgan Special: Deal Maker of the Year 2023 (Part 01)

Shots:

- As the year began, PharmaShots was busy analyzing the deals throughout 2023 to prepare a special report, viz. JP Morgan 2024 Special: Deal Maker of the Year 2023 (Part 01)

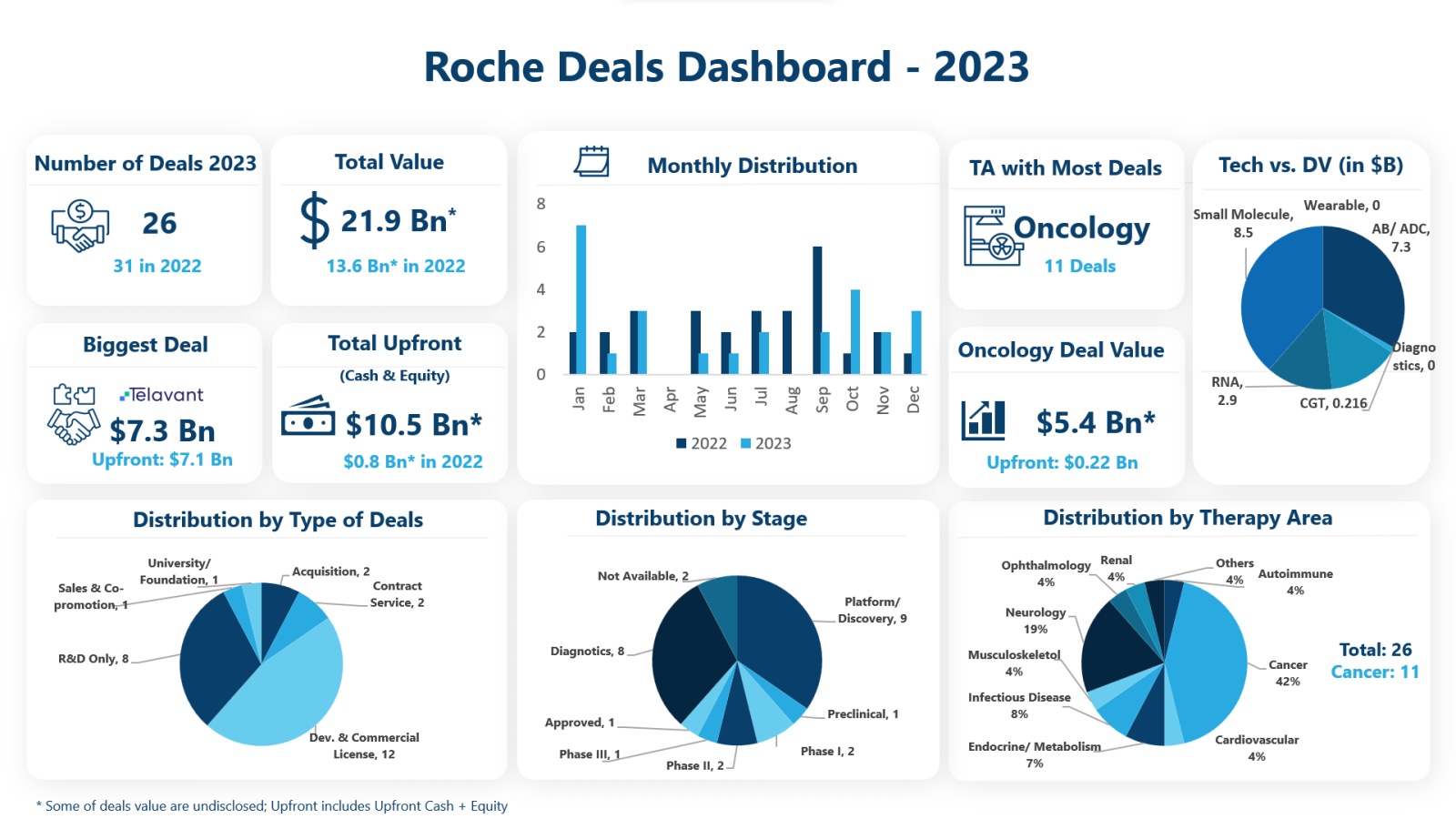

- The report features Roche, that signed 26 collaborations comprising acquisitions, contract services, development & commercialization, license, R&D, and product purchases

- Propelled by the invaluable insights from DealForma, PharmaShots brings an on-demand report on the Dealmaker of the Year 2023

Summary

Driven by stringent anti-trust laws and a highly competitive fundraising environment, striking deals of any sort became challenging for both seed-stage and well-established pharmaceutical companies in 2023. Midst such challenges, the pharmaceutical industry witnessed undulating strategic collaborations, partnerships, and mergers. Based on the trends of dealmaking in the healthcare sector, PharmaShots worked on the Dealmaker of the Year, in 2023 by analyzing the data collected from DealForma. The top dealmakers of the year, according to the number of agreements each biopharma company inked, were Roche (26), AstraZeneca (22), Merck (20) and Eli Lilly (20). Roche topped the list with the greatest number of signed collaborations in 2023. Here is a selection of Roche's best dealmaking highlights from 2023 brought to you by PharmaShots.

Roche is a renowned multi-disciplinary company in the biopharma, medical devices, health-tech sector that develops therapies focusing on Oncology, Immunology, Ophthalmology, Cardiovascular, and Respiratory. Roche is a prominent name in developing Pharmaceutical and Diagnostic Products. The company functions under two divisions, Pharmaceutical & Diagnostics. The overall sales generated by Roche in 2022 were $68.45B, out of which the pharmaceutical sales accounted for $49.27B. Roche’s lead assets, Ocrevus ($6.53B), Perjeta ($4.42B), and Hemlibra ($4.13B) were the highest contributors.

In 2023, Roche participated in around 26 signed collaborations comprising acquisitions, contract services, development & commercialization, license, R&D, and product purchases, among others. Roche withholds a total announced deal value of $21.88B, excluding the undisclosed deals, in 2023. Out of the total 26 deals, the maximum number of deals signed were under development and commercialization licensing (N=12), followed by R&D (N=8), Contract Services (N=2), Acquisitions (N=2), and Sales & co-promotion and University agreements, both accounted for 1 deal each. Moreover, Roche was also involved in deals related to university partnerships along with sales or co-promotions.

Insights:

- In terms of the number of signed transactions, Roche was the top Dealmaker in 2022 with about 31 deals. The company only signed about 26 transactions in 2023, but the overall deal value was more than what it had generated in 2022

- In 2022 the total deal value added up to $13.5B whereas, in 2023, the total deal value generated was $21.9B, depicting a 62.2% boost in value

- Moreover, In 2022 September was the uplifting month for Roche but in 2023 January turned out to be the most fruitful month for the company

- In 2023, cancer continued to be the highest priority indication for Roche, continuing the patterns from 2022

- Apart from Development and Commercialization Deals, Roche had mostly signed Contract Service Deals in 2022 but in 2023 the company indulged more in Research & Development Deals at the second spot

Top Deals for Roche

Total Deal Value: $7.25B

Shots:

- As per the agreement, Telavant will receive an upfront of $7.1B & a near-term milestone payment of $150M whereas Roche received further development & manufacturing rights for RVT-3101 (TL1A inhibitor)

- Roche will be responsible for the commercialization of RVT-3101 across the US & Japan post-pending clinical & regulatory success & initiating the global P-III clinical trial for RVT-3101 to treat IBD. Additionally, Pfizer is responsible for the commercialization of RVT-3101 in areas outside the US & Japan

- Post-closing of the transaction (expected by Q4’23 or Q1’24), Roche will have the option to enter into a global collaboration with Pfizer for next-generation p40/ TL1A directed bispecific Ab in P-I clinical trial

2. Roche to Acquire Carmot Therapeutics for ~$3.1B

Total Deal Value: $3.10B

Shots:

- Roche announces the acquisition of Carmot Therapeutics providing access to Carmot's portfolio, incl. CT-388 & CT-996, offering treatments for obesity in patients with & without diabetes

- Under the agreement Carmot is qualified to receive an up front of $2.7B in cash & with potential milestone payments of up to $400M. Moreover, Roche gains access to Carmot's R&D assets, incl. clinical and pre-clinical portfolios. The transaction is expected to close in Q1’24

- Upon finalizing the agreement, Roche will secure exclusive rights to Carmot's innovative Chemotype Evolution discovery platform, strengthening Roche's R&D capabilities & expanding its portfolio in cardiovascular and metabolic diseases

Total Deal Value: $3.07B

Shots:

- Monte Rosa Therapeutics will receive $50M up front and is eligible to receive ~$2B in future preclinical, clinical, commercial, and sales milestones along with tiered royalties

- Monte Rosa Therapeutics will be responsible for the discovery and preclinical activities against multiple select cancer and neurological diseases & holds full ownership of its pipeline programs while Roche will get the right for further preclinical and clinical development of the compounds

- The collaboration combines Monte Rosa Therapeutics’ highly differentiated QuEEN discovery engine with Roche’s strong expertise in delivering transformative therapies to patients

Total Deal Value: $2.8B

Shots:

- Alnylam will receive $310M up front, additional near-term fees incl. development milestones over the next few years, regulatory & sales milestones for ~$2.8B along with royalties on net sales of zilebesiran outside the US as well as an equal share of profits & losses in the US

- Alnylam to get an equal profit share in the US & will lead a joint clinical development plan for 1st indication with Roche’s participation incl. cardiovascular outcomes trial with development costs shared 40% by Alnylam & 60% by Roche

- Roche will get an exclusive right to commercialize zilebesiran outside the US & may lead development for additional indications in the future. The collaboration will combine Alnylam’s leadership in RNAi therapeutics with Roche’s global commercial reach to develop & launch innovative therapies globally for sev. cardiovascular diseases

Total Deal Value: $2.08B

Shots:

- Under the terms of the agreement, Belharra will receive $80M up front & is eligible for ~$2B in development & commercial milestones incl. tiered royalties in exchange for the worldwide rights to develop & commercialize small molecule therapies in oncology, immuno-oncology, autoimmune & neurodegenerative diseases

- In addition, Belharra received an option to co-develop certain oncology & autoimmune therapies through P-I & co-fund the remaining development in exchange for US cost/profit split & ex-US milestone payments & royalties

- Belharra will be responsible for the discovery & early preclinical development whereas Genentech will look after the target selection & late preclinical, clinical & commercial activities

Disclaimer:

- PharmaShots has not included Clinical Trial Agreements and Joint Ventures

- Overall deal value is higher than mentioned as Roche has ~15 undisclosed deals

Related Posts: JP Morgan Special: Dealmaker 2022 – Top M&A Deal of Roche (Part 01)

Tags

Shivani is a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She covers news related to Product approvals, clinical trial results, and updates. She can be contacted at connect@pharmashots.com.